Regional Enhancement Millage

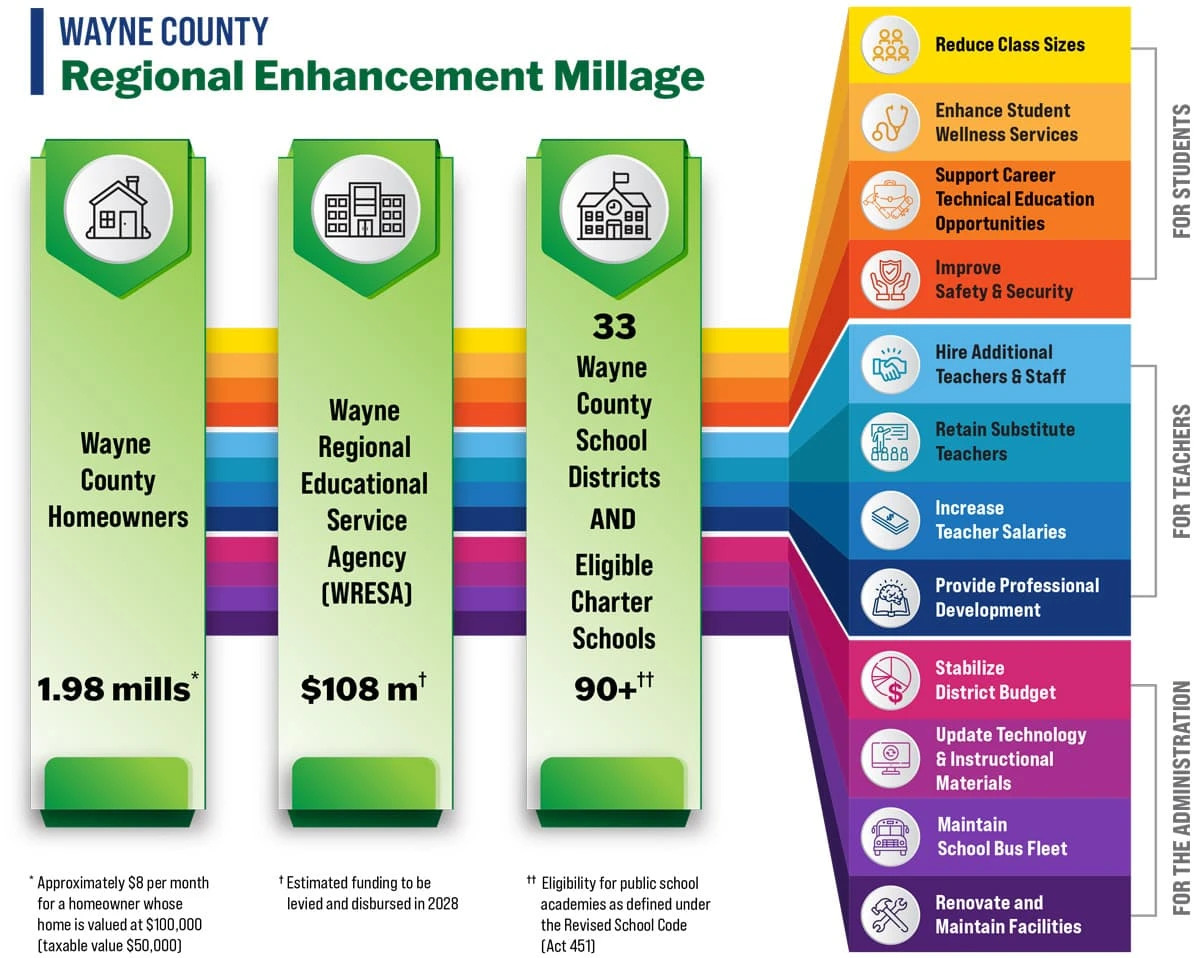

The Wayne County Regional Enhancement Millage is up for renewal on Nov. 5, 2024, and helps prepare our students for success. The current millage helps Wayne County students achieve, succeed, and prepare for in-demand careers.

The voters in Wayne County first approved this millage in 2016 then renewed it in 2022, for 2 mills funded over 6 years. The Wayne County Regional Enhancement Millage provides important supplemental funding to our schools in addition to state funding. 100 percent of the funding is distributed equally per student to all 33 school districts and 90+ eligible public school academies in Wayne County. It includes strong accountability and transparency measures that are monitored to ensure it produces results for our students.

If renewed, this millage will continue the less than 2-mill property tax each year for six years, beginning in 2028. This is not a tax increase. A homeowner whose home is valued at $100,000 (taxable value of $50,000) would continue paying about $8 per month with this renewal.

How Districts and PSAs Use Enhancement Funds

Funds distributed from the revenue generated by the enhancement millage can be used for any legal purpose. Here are just some of the ways that Wayne County local school districts and eligible public school academies have used their disbursements to benefit students, teachers and administration since the millage was initiated in 2016.

For Students

- Reduce Class Sizes

- Enhance Student Wellness Services

- Support Career Technical Education Programs

- Improve Safety & Security

For Teachers

- Hire Additional Teachers & Staff

- Retain Substitute Teachers

- Increase Teacher Salaries

- Provide Professional Development

For Administration

- Stabilize District Budget

- Update Technology & Instructional Materials

- Maintain School Bus Fleet

- Renovate & Maintain Facilities

Wayne County Regional Enhancement Millage Timeline

2016-2022

First Millage

Nov. 2020 Ballot

Voters Renew Millage

Nov. 5, 2024 Ballot

Millage up for Renewal

100% of Funds Distributed to School Districts and Eligible PSAs

By law, 100% of the revenues generated by an enhancement millage must be distributed to all of the local school districts and eligible public school academies within the county based on the most current student count.

Eligibility for public school academies is defined under the The Revised School Code (Act 451 of 1976).

Wayne RESA receives no funding from the enhancement millage.

The Wayne County Regional Enhancement Millage is up for renewal and will appear on your Nov. 5, 2024 ballot. Make your voice heard!

The current millage provides funding to the constituent school districts and eligible public school academies in Wayne County for the 2022-2023 fiscal year through the 2027-2028 fiscal year. 100 percent of the funding is distributed equally on a per student basis. Our schools decide how to use the money to best support their students and families, which can include improving Career and Technical Education programs that help prepare students for good-paying jobs in the skilled trades; helping districts hire the best teachers to reduce class sizes and provide tools proven to help students succeed; supporting special education services; and improving school safety and security.

Michigan law requires Wayne RESA to bring millage proposals to the voters in even years during August primaries or the November general election. Given those restrictions, Wayne RESA put the proposal of renewing the, 2 mill, 6 year enhancement millage on the ballot in November of 2020 and it passed. The renewed millage provides funding to the constituent school districts and eligible public school academies in Wayne County for the 2022-2023 fiscal year through the 2027-2028 fiscal year. If renewed, this millage will continue the less than 2-mill property tax each year for six years, beginning in 2028.